In the ever-evolving short-term rental market, understanding where your bookings and revenue are coming from is crucial for staying competitive and driving sustainable growth.

We recently conducted a detailed analysis of booking volume and revenue distribution across various platforms for our portfolio of short-term rental properties, and the results highlighted the importance of platform diversification.

By analyzing the performance of major OTAs (online travel agencies), we can draw valuable conclusions about how to optimize your listings across platforms and capture both high-value and high-volume bookings.

Our amazing team is always hard at work

Here are the key takeaways from the data.

Key Takeaways from the Data:

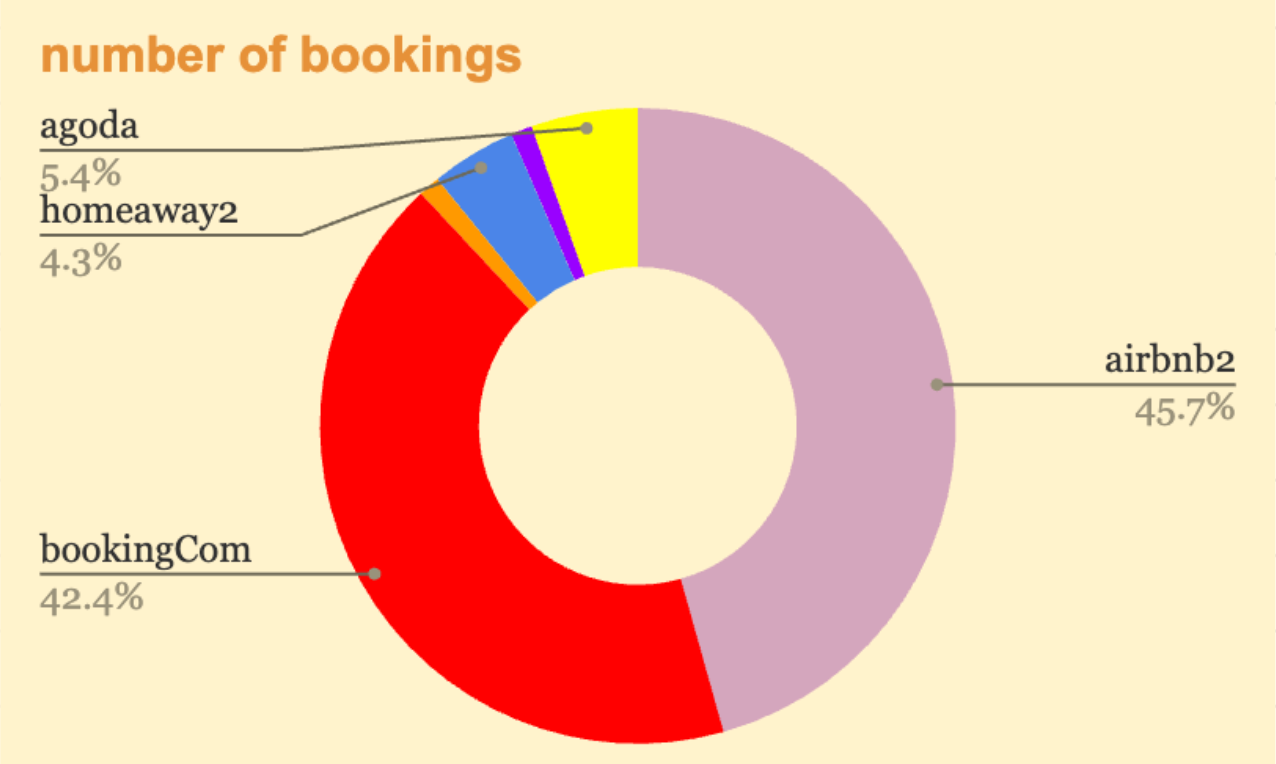

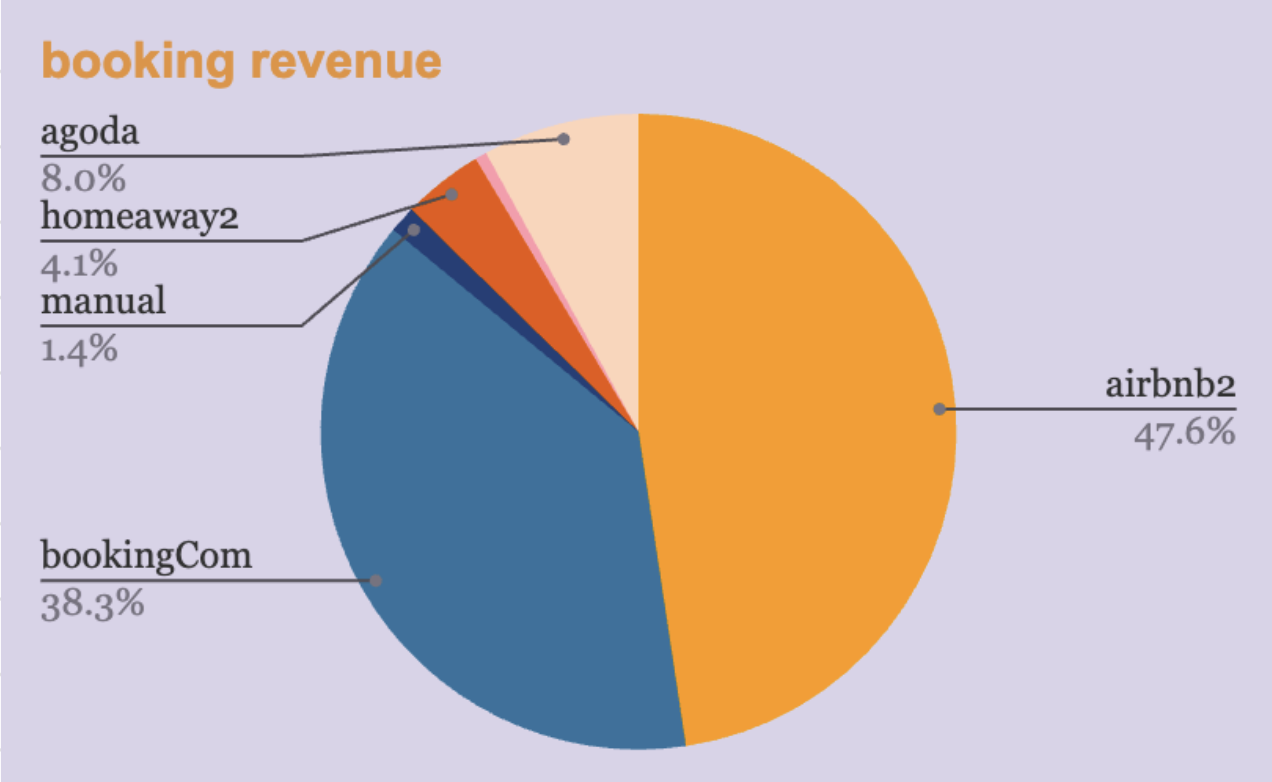

1 . Airbnb: Still the Dominant Player

• Booking volume: 45.7%

• Revenue contribution: 47.6%

Despite growing competition, Airbnb continues to dominate the short-term rental market, driving nearly half of all bookings and revenue. This dominance can be attributed to its large, global user base and focus on both leisure and extended stays. For property managers, maintaining a strong presence on Airbnb is essential for maximizing revenue and maintaining high occupancy rates.

Strategic Implication:

Optimize Airbnb listings by enhancing property descriptions, using professional photography, and leveraging dynamic pricing tools. While it’s important to prioritize Airbnb due to its sheer volume, diversifying to other platforms helps mitigate the risk of over-reliance on a single OTA.

Booking.com is nearly on par with Airbnb in terms of booking volume but generates slightly lower revenue. This platform excels in attracting short-term stays and business travelers, especially in urban areas. Although the per-booking revenue may be lower than Airbnb, it still provides a critical channel for filling vacancies, particularly during off-peak times.

Strategic Implication:

Leverage Booking.com’s strengths by targeting international travelers and business guests. Utilize special promotions and flexible cancellation policies to appeal to this segment, ensuring consistent occupancy throughout the year.

3. Agoda: Small but Efficient

• Booking volume: 5.4%

• Revenue contribution: 8.0%

While Agoda accounts for a smaller share of bookings, its higher revenue percentage suggests that its users tend to book higher-value stays. Agoda’s focus on the Asian market makes it a vital platform for targeting international travelers, particularly in urban locations with strong tourism appeal.

Strategic Implication:

Property owners in tourist-heavy regions or those catering to international guests should prioritize optimizing their Agoda listings. Highlight cultural proximity, language-specific services, and guest preferences to maximize appeal.

4. HomeAway (Vrbo): A Solid Choice for Families and Groups

• Booking volume: 4.3%

• Revenue contribution: 4.1%

HomeAway (part of Vrbo) remains a go-to platform for families and groups, which is reflected in its consistent contribution to both booking volume and revenue. Although it doesn’t command the same share as Airbnb or Booking.com, it remains an important platform for properties that cater to family-oriented vacationers.

Strategic Implication:

Focus on listing larger properties with family-friendly amenities, such as kitchens, outdoor spaces, and multiple bedrooms, to maximize HomeAway’s potential.

5. Manual Bookings: Lower Volume, Higher Control

• Revenue contribution: 1.4%

Manual or direct bookings represent the smallest share of revenue but offer the greatest level of control over the guest experience. Direct bookings eliminate OTA fees, allowing property managers to offer more personalized services and retain higher margins.

Strategic Implication:

Building a robust direct booking strategy can significantly improve profitability. Use your website, email marketing, and social media to attract repeat guests, offering discounts or value-added services to incentivize direct bookings.

The Importance of a Diversified OTA Strategy

The data makes it clear that relying solely on a single platform—regardless of its market share—leaves property managers vulnerable to shifts in platform policies, algorithms, and guest behaviors. By diversifying your OTA strategy, you can capture high-value and high-volume bookings from various guest segments, ensuring steady revenue and occupancy throughout the year.

Actionable Steps for Property Managers:

1.Platform-Specific Optimization: Tailor your listings to match the strengths of each platform. For example, focus on family-friendly amenities for HomeAway, luxury features for Homes & Villas by Marriott, and cultural relevance for Agoda.

2. Leverage Dynamic Pricing: Ensure that your pricing strategy is optimized for peak times and shoulder seasons on all platforms.

3.Build Direct Booking Channels: Create and promote a direct booking system through your website or other channels to maximize profit margins and build stronger guest relationships.

By adopting a multi-platform strategy, you can reduce risk, expand your market reach, and increase both booking volume and revenue across various guest segments.

💼Want to learn more about optimizing your short-term rental strategy across multiple OTAs?

Let’s connect to discuss how we can help you achieve better revenue performance and occupancy rates!